Every new year, there are endless lists of new year resolutions, particularly geared towards finance and 2021 was no different. But how can you make and stick to your financial resolutions

For most of us, the word “budgeting” feels like spiders in a dark room—creepy. It’s not easy accounting for every penny you receive (and spend) just because it feels better to be non-accountable. This is where budgeting apps come on the scene and many a financial lives they have made accountable and easy.

Once you input your data, these apps cut right to the chase to give a bird-eye-view of our finances. These budgeting apps are designed differently since every individual has different ways of managing their money. That being said, the word “best” is relative as what works for A might not necessarily work for B.

.

Here are a few of the best budgeting apps to explore…

.

#1. You need a budget

This app allows you to link your major accounts (optional) to account for every penny you make. The No.1 rule of this app is “give every dollar a job.” If you’re in search of a more detailed and intricate budgeting style, then this is the app for you. This budgeting app doesn’t allow forecasting; it works with the cash you have presently, tracks your cash, and offers daily workshops on budgeting, debts, saving culture, among other educational resources. This app is free for the first 34 days, after which you pay $84 annually or monthly at $11.99. Quite affordable for all the features it boasts.

.

#2. Good budget

This app is a digital envelope that provides real-time transparency across all devices. If you’re a couple searching for budgeting apps, this one suits that purpose. Both parties can monitor the cash inflow and outflow conveniently. It helps couples save towards big goals like a new house or a much-needed vacay, but works pretty well for an individual also. Once cash is paid into your account, it’s easier to find your envelope and allocate bills accordingly. For the basic option (which is free, by the way), a maximum of 10 envelopes is allowed. Fair enough.

#3. Pocket guard

What a name? It explains a lot. Pocket guard ensures you don’t overspend by guarding your pocket. It also helps you lower your spending by finding better deals on your service/utility costs. Once it’s connected to your bank account, this app tracks deposits into your account while monitoring your constant bills and daily expenses. If that isn’t amazing, we wonder what is.

.

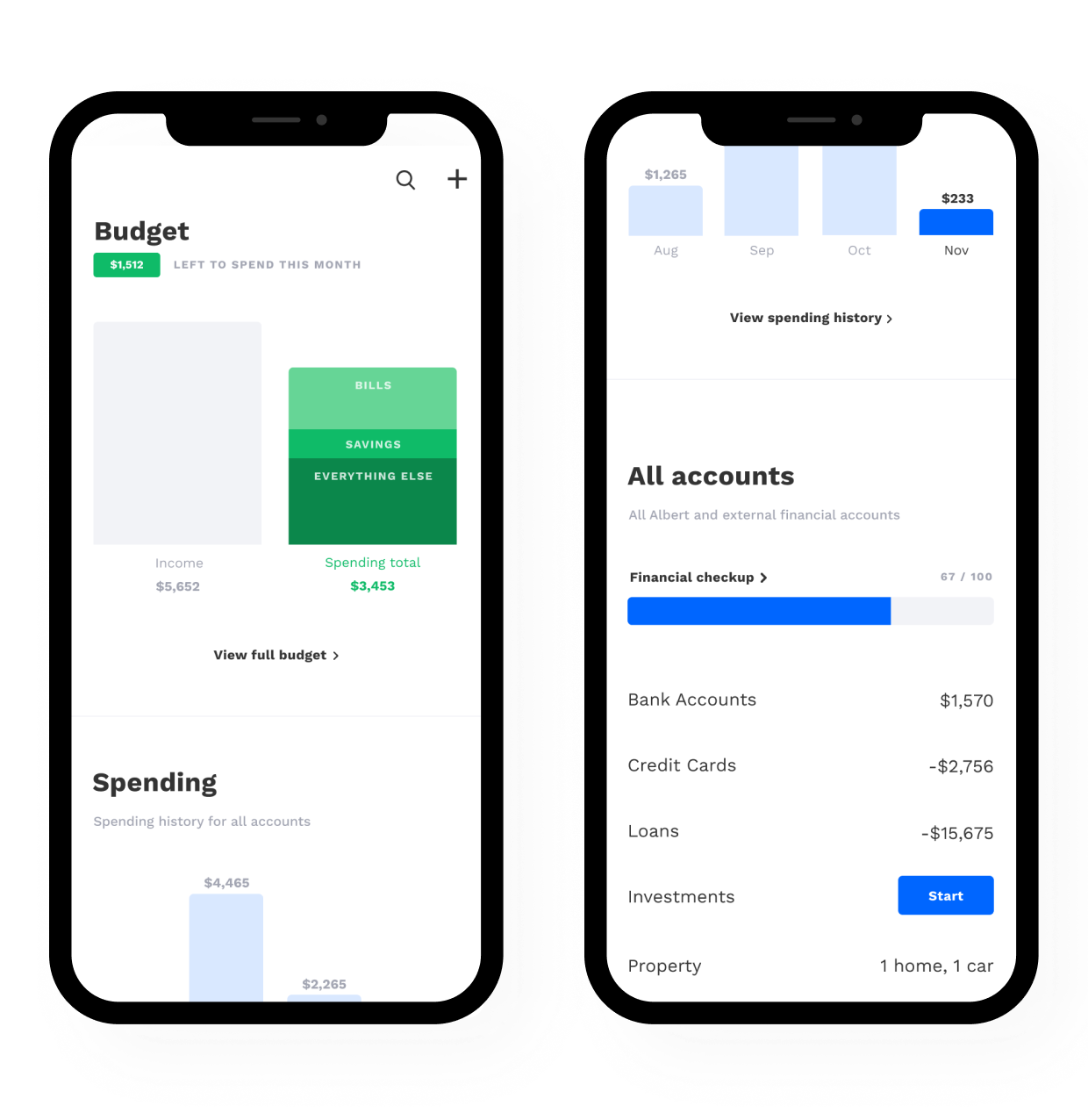

#4. Albert

This app is interesting because it takes off you the constant need to supervise the transactions and activities. All you need do is connect it to your account and go on with your life. It uses proprietary algorithms to decide how much you can safely put away each month, then automatically transfers that money into Albert Savings after analyzing your overall financial capacity. If you’d rather decide, you can input the specific amount you want to be saved, and Albert will be at your service. Talk about a financial wizard!

.

#5. Mint

If you’re more focused on saving more and spending less, as the case with every frugal person, you’re in the right place. This long-standing app resonates with many individuals and it would be an anomaly if it doesn’t appear on this list. Mint helps guide your day-to-day spending by automatically sectionalizing your expenses and alerting you to spendings outside the usual budget. The best part is the app is free and trusted. Cool, isn’t it?

.

A budget isn’t about restricting what you can spend, but rather permitting you to spend without regrets. You can confidently tell your money where to go and that, my friend, is bliss.

Featured Image: Cottonbro | Pexels

For the latest in fashion, lifestyle and culture, follow us on Instagram @StyleRave_