Offering exclusivity while creating an inclusive culture, alternating classic and trend-oriented

products, responding to the expectations of young consumers: these are some of the elements that have allowed Gucci to achieve explosive growth from 2015 to 2019. A study from automated benchmarking specialist Retviews has broken down the brand's strategy and the way in which it is readjusting its offering in order to win back terrain after two years of slowing sales.

Led by CEO Marco Bizzarri and creative director Alessandro Michele, who took over in 2015, the driving force behind Kering, which accounts for 60% of the luxury giant's total sales, has repositioned itself around an exuberant and offbeat aesthetic with the aim of offering exclusive products, while also creating an inclusive culture. This strategy has allowed the brand to gain visibility with young consumers and has made it one of the most highly valued labels of the moment, a status demonstrated by its first-place ranking in the Lyst Index of the most popular brands. As of the last quarter of 2020, Gucci still maintains this top position.

In order to achieve this objective, the luxury fashion house has placed more emphasis on its ready-to-wear. "It's a product which speaks to the widest audience and which can be adapted more easily than accessories to different styles so as to appeal to different segments of the population, which makes Gucci a very inclusive brand," explained the author of the study, Virginie Lê.

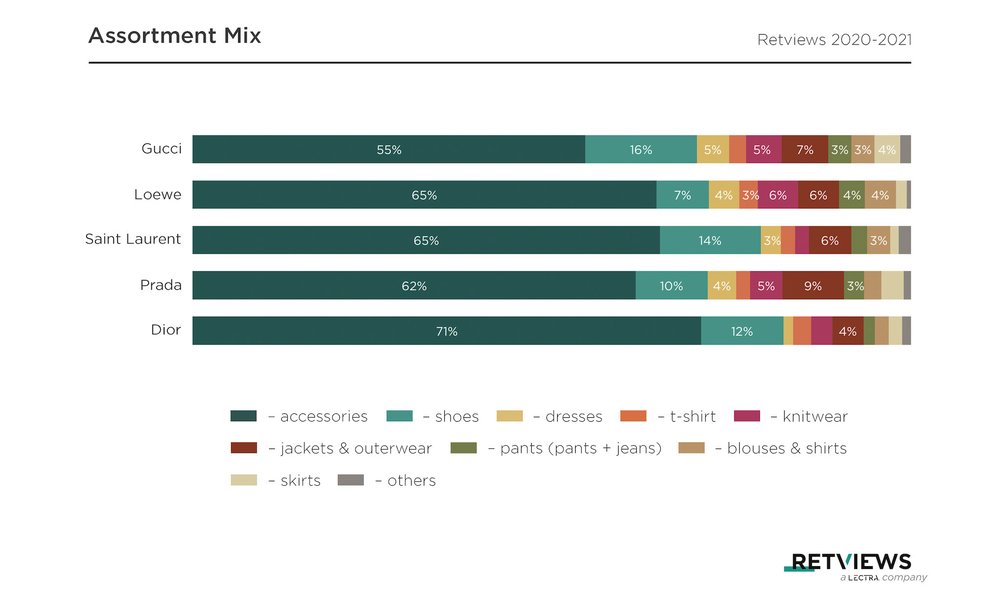

The label dedicates 55% of its offering to accessories (compared to 71% at Dior and 65% at Saint Laurent), 15% to footwear and close to 30% to ready-to-wear, which only makes up 21% and 18% of Saint Laurent and Dior's offerings, respectively. Only Prada and Loewe have adopted a similar model to Gucci, with apparel making up 28% of their offerings.

It's worth noting that the ready-to-wear division only generates 18% of the Italian brand's revenues, despite accounting for around a third of its offering, as it is above all a way of communicating with young consumers. Gucci's strategy consists in capitalizing on trends by rapidly adapting its products to the goût du jour, reflecting the practices of mass market fast fashion brands. "Ready-to-wear allows them to be more reactive. When a product works well, they push it. If it's not working anymore, it automatically disappears," continued the analyst.

"Kering and Gucci have figured out how to speak to the younger generation — a value-driven cohort searching for inclusivity and empowerment. In terms of style, Gucci beat out its competitors to capitalize on the mini- to nano-bag trend," says Retviews. "Reimagining its iconic bags in smaller sizes and balancing classic colors with fashion-forward hues, Gucci put its inclusivity objective on display."

"[For] luxury brands, which depend on sales of core groups of largely unchanged staple products season after season, trend-driven items can provide the much-needed relevance and buzz that helps brands stay at the center of the cultural conversation," adds the report. This strategy does, however, risk compromising the brand's integrity and driving away its traditional fans.

Gucci has mitigated this risk by evolving, rather than revolutionizing, its assortment, and according to Retviews, the strategy has paid off. Alongside its classic pieces, which make up 51% of its offering, compared to 56% at Christian Dior, 78% at Prada and 100% at Saint Laurent, Gucci has therefore introduced new, more fashion-forward products, while also adapting some of its most iconic pieces to current trends.

According to data compiled by the analyst, "Gucci has the highest share of fashion-oriented articles than its competitors — especially in shoes," with this kind of product accounting for 49% of its offering, compared to 44% at Dior, 22% at Prada and 36% at Loewe.

Certain innovations, such as the brand's famous fur loafers, can become classics, while classics that are no longer resonating with consumers can be pulled from the shelves. Up until now, this strategy has worked out, allowing the brand to stay relevant and attractive to consumers of all ages by offering both timeless classics and trend-oriented products that can appeal to all tastes. However, faced with slowing sales, the brand could be forced to review its approach.

In an interview with the press, Gucci boss Marco Bizzarri stated that the brand's objective was to strike a balance between 30% new products and 70% carry-over. "Having focused on millennials and Gen Z over the last few years, Gucci will have to reverse the trend in order to reach traditional customers with stronger purchasing power, who are in search of timeless produces," observed Lê.

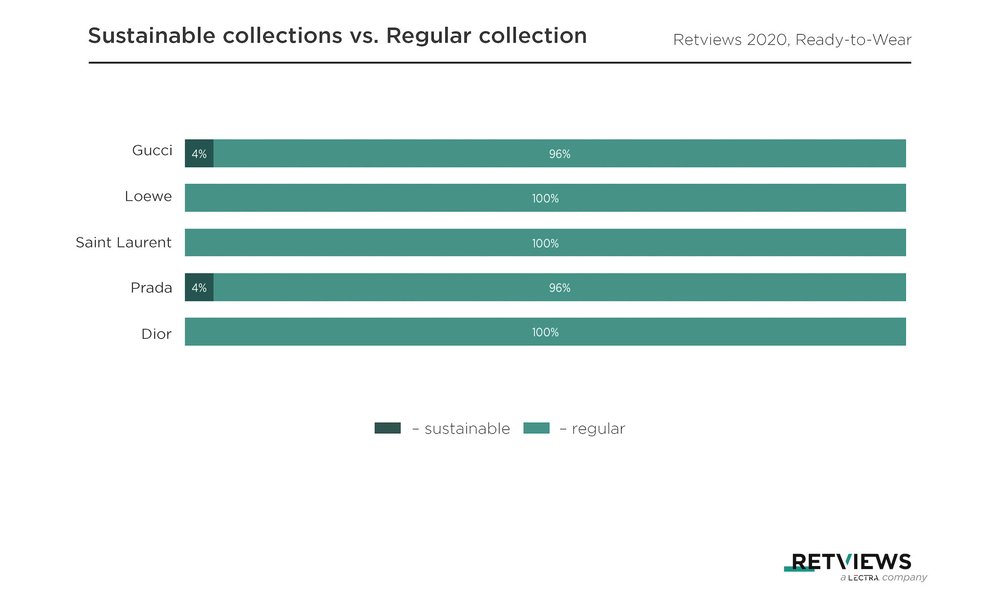

Finally, from a sustainable point of view, Gucci's offering does not reflect the efforts being made by Kering to ensure that its supply chain is having a less negative impact on the environment. Since 2018, the brand has achieved carbon neutrality and received various sustainability certifications. The label also recently invested in online resale platform Vestiaire Collective.

"If we look solely at the ‘eco-responsible’ products labeled by the fashion house in Gucci’s case, one could state that the Italian company isn’t doing much in sustainability. However, results are even gloomier from its competitors’ side," explains Retviews. The share of eco-responsible products in Gucci's offering is 4%, the same as Prada, while the figure is 0% at the other brands cited by the study. Retviews also mentions the recurrent use of wool in ready-to-wear collections, as it is considered to be a relatively sustainable material when compared to cotton. Wool appears in 33% of Gucci products, while the share ranges from 14% to 20% at the other mentioned brands.

In addition, the brand makes much fewer products than the other labels, but engages in more intense communication about new launches, creating the impression of abundance. 2020, for example, saw the production of 2,180 Gucci products, compared to more than 3,000 at Dior and 4,000 at Prada. According to Retviews, the brand would do well to offer clearer communication concerning its sustainable commitments.