The internet has become a compulsory stop on the consumer journey,

a trend which is relatively new in the luxury sector, but which has received a major boost due to the pandemic. It has therefore become vital for brands to understand the different steps of this online pre-purchase process, as well as the criteria that are taken into account before making a purchase decision, and the most popular platforms and digital formats consulted. Habits have clearly changed, and videos now play a central role in this process, as demonstrated by a study carried out by Google and marketing consulting firm Kantar, which identifies the latest consumption trends specific to the luxury sector.

The "Connected Luxury" study surveyed 4,500 people in seven countries (Germany, Saudi Arabia, the U.S., France, Italy, Japan, and the UK) between July and September 2020, asking them about the purchases of leather goods, jewellery, watches and clothing that they had made from September 2019 to September 2020. Google carried out a similar survey in 2016 and, four years later, there are three strong trends that have emerged: the explosive progress made by e-commerce, especially in the luxury industry, the growing importance of digital media in the consumer journey, and the overwhelming use of videos, particularly on YouTube.

"According to our survey, it's the second most popular search engine after Google and is used at every step before purchase. There has been strong growth in fashion content on YouTube, especially with digital runways, which can be archived there by brands. The idea of having a repertoire is stronger on this site than elsewhere. Luxury shoppers find both inspiration and information there, through the brands' channels, but also through those of Youtubers, whose product commentaries they consult. This opinion, this social proof, is essential," explains Alicia Barr, head of consumer insight studies at Google.

According to the study, 93% of luxury shoppers carry out research online before making a purchase. That said, it seems that these consumers are always on the look-out for information, with 88% saying that they also search offline and 79% revealing that they use their mobiles. Brands must therefore be present and relevant across different platforms.

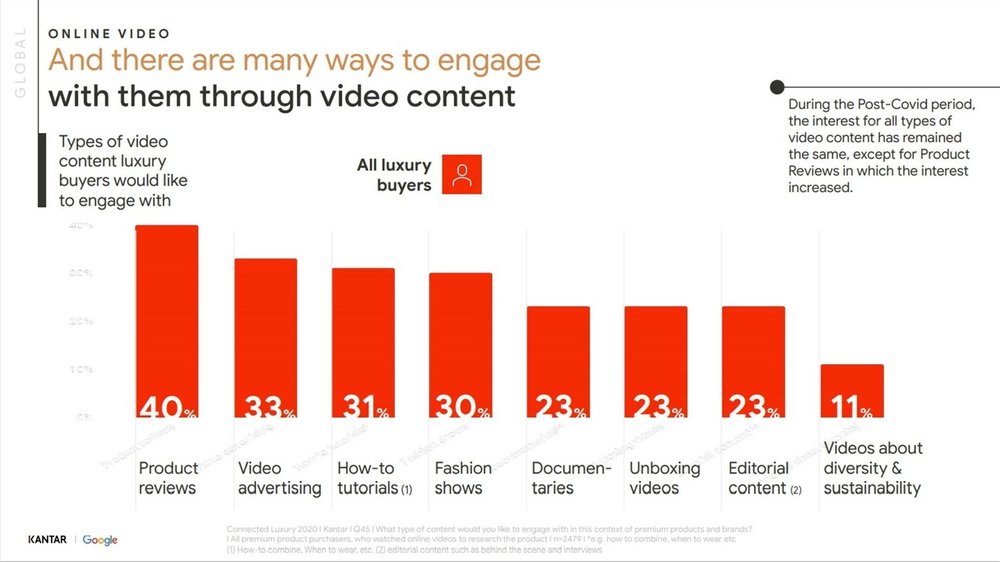

The online journey can be split into seven key moments: the identification between a shopper and the brand that fits them best, inspiration, personalisation in order to find the most appropriate product, product analysis – with a particular focus on manufacturing, recommendation via social proof, consideration of both online and physical purchasing options, and the purchasing experience.

"It's rare for someone to go through all of these phases, the most important ones being inspiration and the identification of a purchasing location. At each step, the most valued touchpoint is the brand's site. This is why it's important that brands do not neglect their own sites and that they continue to invest in them, as well as in their digital presence," emphasises Barr.

71% of survey respondents said that they use the brand's website as a touchpoint when searching for information about products, while 70% mentioned search engines, 61% spoke about social networks and 55% cited online videos, which are seen as particularly important.

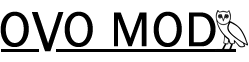

In particular, consumers put their trust in product reviews, cited by 40%, video advertising (33%), tutorials (31%) and digital fashion shows (30%). 60% of under-29-year-olds watch videos online before buying, a figure which drops to 57% for shoppers aged between 30 and 49, and to 38% among the over 50s. This kind of video is one of the main sources of information in the U.S., having been cited by 70% of surveyed Americans.

Google and YouTube are the platforms of choice for finding information, having been mentioned by 67% and 51% of survey respondents, respectively. The trusty Google search is particularly present at the moment of inspiration, when shoppers discover luxury products. It also facilitates omnichannel flow in the consumer journey, as 73% of shoppers said that they use search engines to find the addresses of brick-and-mortar stores.

However, when it comes to the platforms that are used in order to follow brands, the study highlights the importance of YouTube, which is used by 43% of consumers, Instagram (25%), Facebook (16%) and Pinterest (10%), while also pointing out that subscribing to a channel strengthens the engagement of potential customers.

As for the criteria that determine which luxury purchase will be made over another, the study puts brand image – mentioned by 44% of survey respondents – in first place. Next in line is the designer's reputation (44%), followed by craftsmanship and the quality of the product (37%). Although important, the values and commitments of the label in question are ultimately secondary, being cited as a decisive factor by only 26% of those surveyed.

Another interesting fact highlighted by the study is consumers' strong attachment to brands. 56% of luxury consumers stick to a small selection of brands, with 25% remaining faithful to a single label, a figure which rises to 44% in the United States. This loyalty to a single brand is also particularly present among jewellery and watch consumers, attested by 36% and 26% of these groups, respectively. This further emphasises the importance of brand exposure throughout the consumer journey.

Luxury consumers have very varied profiles, depending on product category, age and market, but all of them are interested in a brand's clout. Excellence and elegance are universal selling points for luxury products but are particularly important for consumers over the age of 50. Younger consumers are more interested in personalisation, limited-edition products and the values and message of the brand. Luxury houses should therefore take care to avoid overestimating the importance of young consumers in their marketing and communication, as older consumers with heftier purchasing power do not have the same priorities.

"This study establishes the elements that drive a purchase. The product is at the heart of this process and, ultimately, what matters is one's relationship with creativity. Sometimes there is a discrepancy between what is being shown in the media and what is important for consumers. Above all, what sells is a creative product that consumers like, made by a brand that consumers like. It's down to brands to spotlight the ways in which their sustainable commitments are virtuously reflected in their product manufacturing processes," says Barr.

The study invites "agile luxury brands to find flexible luxury consumers" by achieving a new balance between a selection of dynamics that may seem contradictory. They should seek to maintain "a balance between the continuity of the brand's positioning and the volatility of its selling points, between a diversity of needs and a certain coherence in the way in which information is searched for online, and between the use of videos as a search tool and source of inspiration and skill in driving web users to make a purchase," concluded Barr.